pay my past due excise tax massachusetts

Past due bills that are not marked at the registry can be paid online only after receiving notice from Kelly Ryan. Interest 12 per year from due date to payment date and.

Massachusetts Unemployment Tax 2021 Excise Rate

At City Hall you can pay with cash a.

. You have 30 days to pay this bill from the date of issue. All information provided on an excise tax bill comes directly from the Registry of Motor Vehicles. Excise tax payments are due 30 days from the original date of the bill after which a demand bill will be sent out with interest and penalty.

Call the Taxpayer Referral and Assistance Center at 617-635-4287. Massachusetts State law allows motor vehicle excise tax exemptions for vehicles owned by certain disabled people and veterans former prisoners of war and their surviving spouses and charitable organizations. The 2nd notice of collection is the Demand bill.

Bills are assessed on a calendar basis. Pay my past due excise tax massachusetts. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax. This information will lead you to The State. For more information we created a page all about motor vehicle and boat taxes.

Sending a demand for payment of the excise Set locally up to 30. The place of garaging of the vehicle as of January 1st determines the city or town to which the bill is payable. Past-due Excise tax bills can be paid on-line via the Towns website.

All vehicles in the State of Massachusetts are subject to an annual motor vehicle excise tax. Schedule payment today to occur at a later time. Pay past due excise tax massachusetts.

Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. Find your bill using your license number and date of birth. A person who does not receive a bill is still liable for the excise plus any demand and interest charges accrued.

If the bill goes unpaid interest accrues at 12 per annum. You will not be cleared out of the RMV for non renewal until all past due taxes are paid on all outstanding plates. You must make payment in cash money order or cashiers check to have the mark removed immediately.

Excise Tax is assessed at the rate of 2500 per thousand dollars of taxable value. To make a Payment By Phone 247 please call toll-free 877-415-6045. The excise rate as set by statute is 25 per thousand dollars of.

If you are unable to find your bill try searching by bill type. To complete a search you must provide several pieces of information to ensure we match you to the. If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill.

The IRS contacting you can be stressful. Learn more about late payments and motor vehicle tax. Ad We Can Help With Wage Garnishments Liens Levies and more.

The Deputy Tax Collector for the Town of Norton. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. Payment of the motor vehicle excise is due 30 days from the date the excise bill is issued not mailed.

They also have multiple locations you can pay including. Clicking the payment of choice will display the available options and any associated service fees. Bills that are more than 45 days past due are marked at the registry for non-renewal sent to the Deputy Collector and must be paid to Kelley and RyanPFRyan Deputy of collections.

The bills are prepared from the records of the Massachusetts Registry of Motor Vehicles. Past due excise tax massachusetts real estate. Motor vehicle excise tax bills are due and payable within thirty days from the date of issue.

You will need specific account information to pay by phone. If you have questions regarding your actual bill you may call the tax collector at 978-620-3170. This tax bill is based on the assessed value of your vehicle X by 2500 per thousand of the valuation.

Treasurer Collector Employee Benefits. Nonpayment of a bill triggers a demand bill to be produced and a demand fee of 1500 payable in 14 days. Pay Past Due Excise Tax Bills.

The demand bill will include interest and a 1000 demand fee and is due and payable within 14 days from the date of issue. Please note all online payments will have a 45 processing fee added to your total due. Pay your bill at Boston City Hall.

PAY YOUR BILL ON TIME. Have questions about your bill for the current fiscal year. When the demand bill becomes past due the account is turned over to the Deputy Tax Collector placed on warrant.

You will not be cleared out of the RMV for non renewal until all past due taxes are paid on all outstanding plates. IF YOUR LICENSE IS SUSPENDED YOU MUST PAY WITH CASH OR MONEY ORDER Please use this page to search for delinquent MOTOR VEHICLE EXCISE TAX bills. If you do not fully pay a motor vehicle excise on or before its due date you also have to pay.

If you dont have a copy of your bill you may look it up on the Citys invoice cloud site. You must pay the excise within 30 days of receiving the bill. An additional service fee of 95 will apply.

The excise rate as set by statute is 25 per thousand dollars of valuation. What Payments Can I Make Online. 2018 excise tax commitments unless past due.

If you have any questions regarding setting up an account or finding your bills call City Hall Systems at 508-381-5455. How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal. If you have any question that have not been answered.

If not paid pursuant to massachusetts general law chapter 60 section 15 a demand fee of 1000 will be added. The mark on your registration and. Motor Vehicle Excise Tax bills are due in 30 days.

We work with you and the IRS to settle issues. A tax rate of 10 for every thousand dollars of value is used to calculate boat excise amounts. Please contact the treasuercollectors office or our Deputy Collector Kelly and Ryan Associates at 508-473-9660.

Massachusetts Motor Vehicle Excise Tax Information.

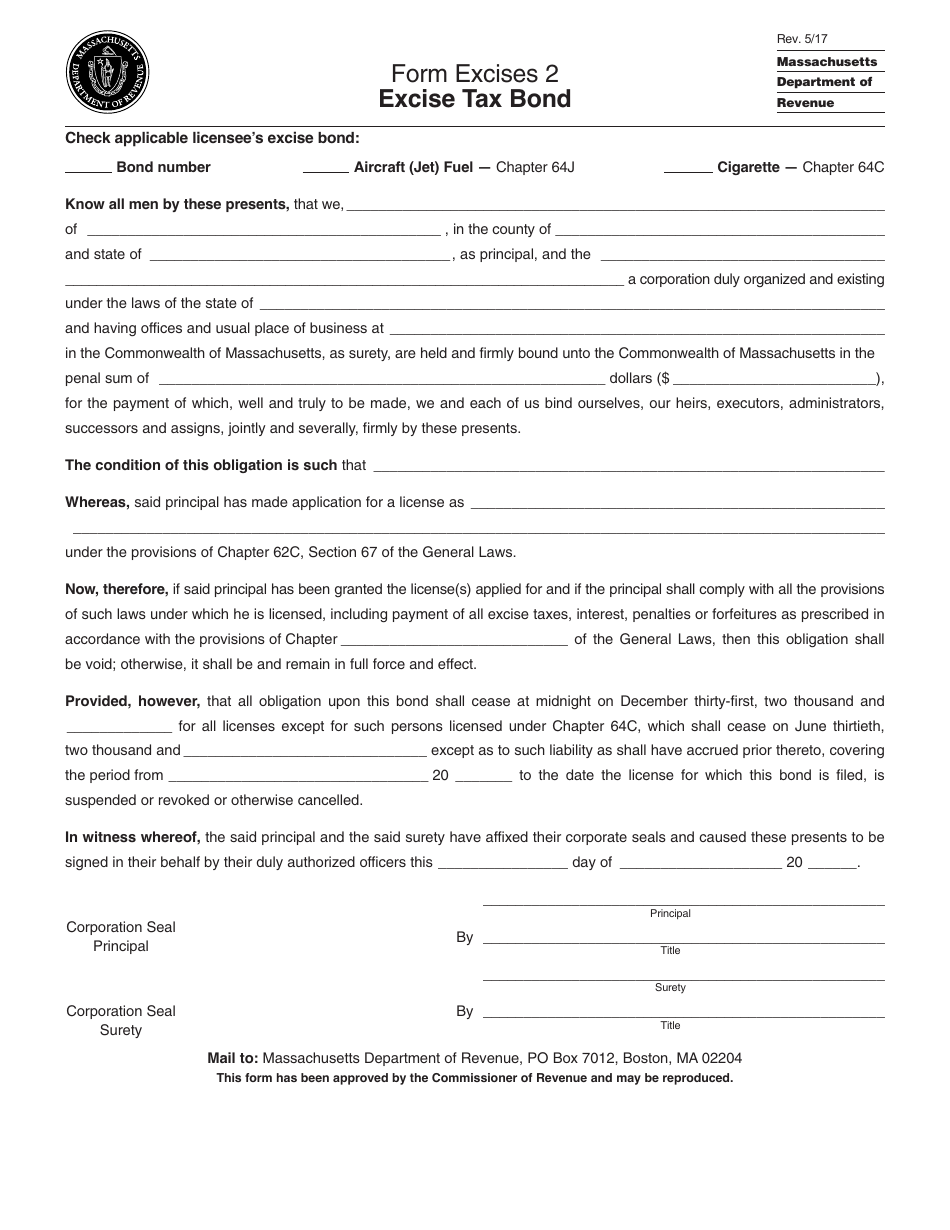

Form Excises2 Download Printable Pdf Or Fill Online Excise Tax Bond Massachusetts Templateroller

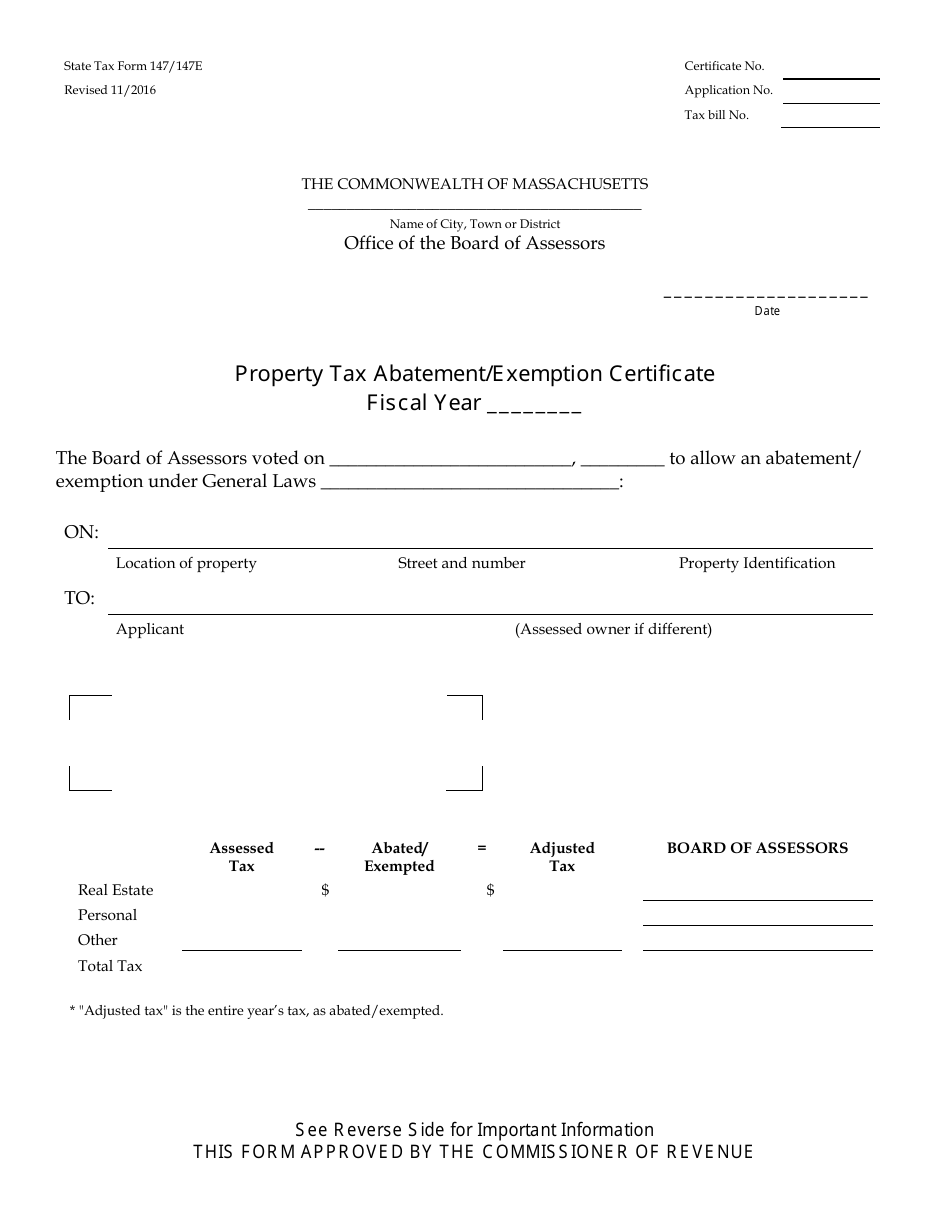

State Form 147 147e Download Fillable Pdf Or Fill Online Property Tax Abatement Exemption Certificate Massachusetts Templateroller

Massachusetts Enacts Pte Elective Excise As Workaround To 10k Salt Cap Tonneson Co

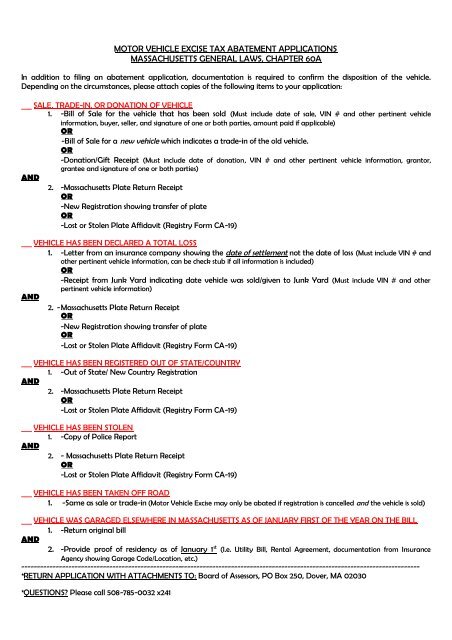

Motor Vehicle Excise Tax Abatement Applications Massachusetts

Motor Vehicle Excise Tax Demand Fee Postponed Marlboroughma

A Guide To Your Annual Motor Vehicle Excise Tax Wwlp

Excise Tax What It Is How It S Calculated

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

1942 Town Of Braintree Massachusetts Excise Tax 2 Trailer Auto Ephemera Braintree Braintree Massachusetts Trailer

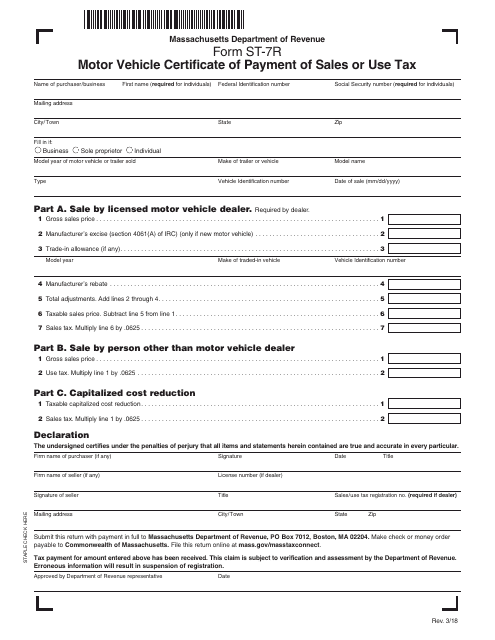

Form St 7r Download Printable Pdf Or Fill Online Motor Vehicle Certificate Of Payment Of Sales Or Use Tax Massachusetts Templateroller

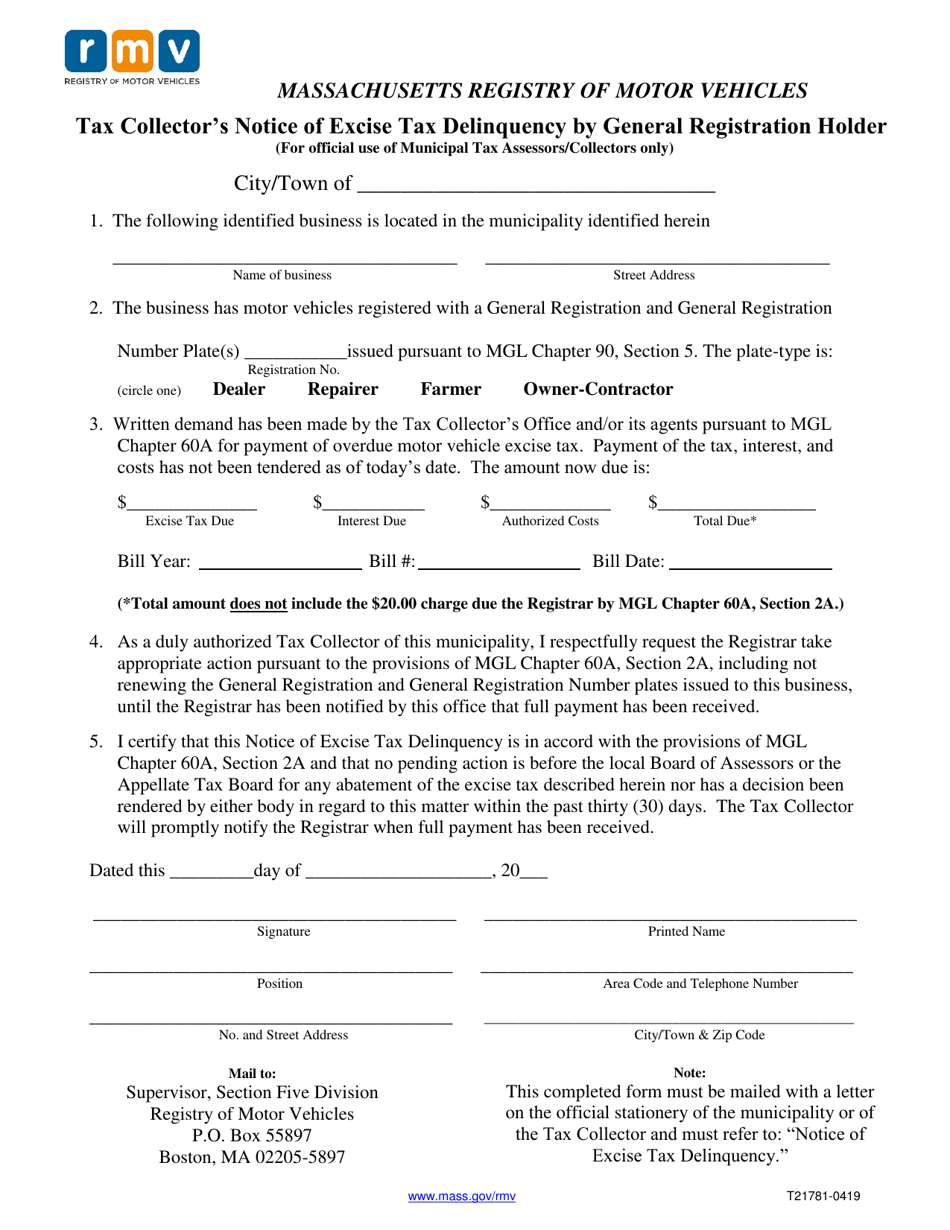

Form T21781 Download Printable Pdf Or Fill Online Tax Collector S Notice Of Excise Tax Delinquency By General Registration Holder For Official Use Of Municipal Tax Assessors Collectors Only Massachusetts Templateroller

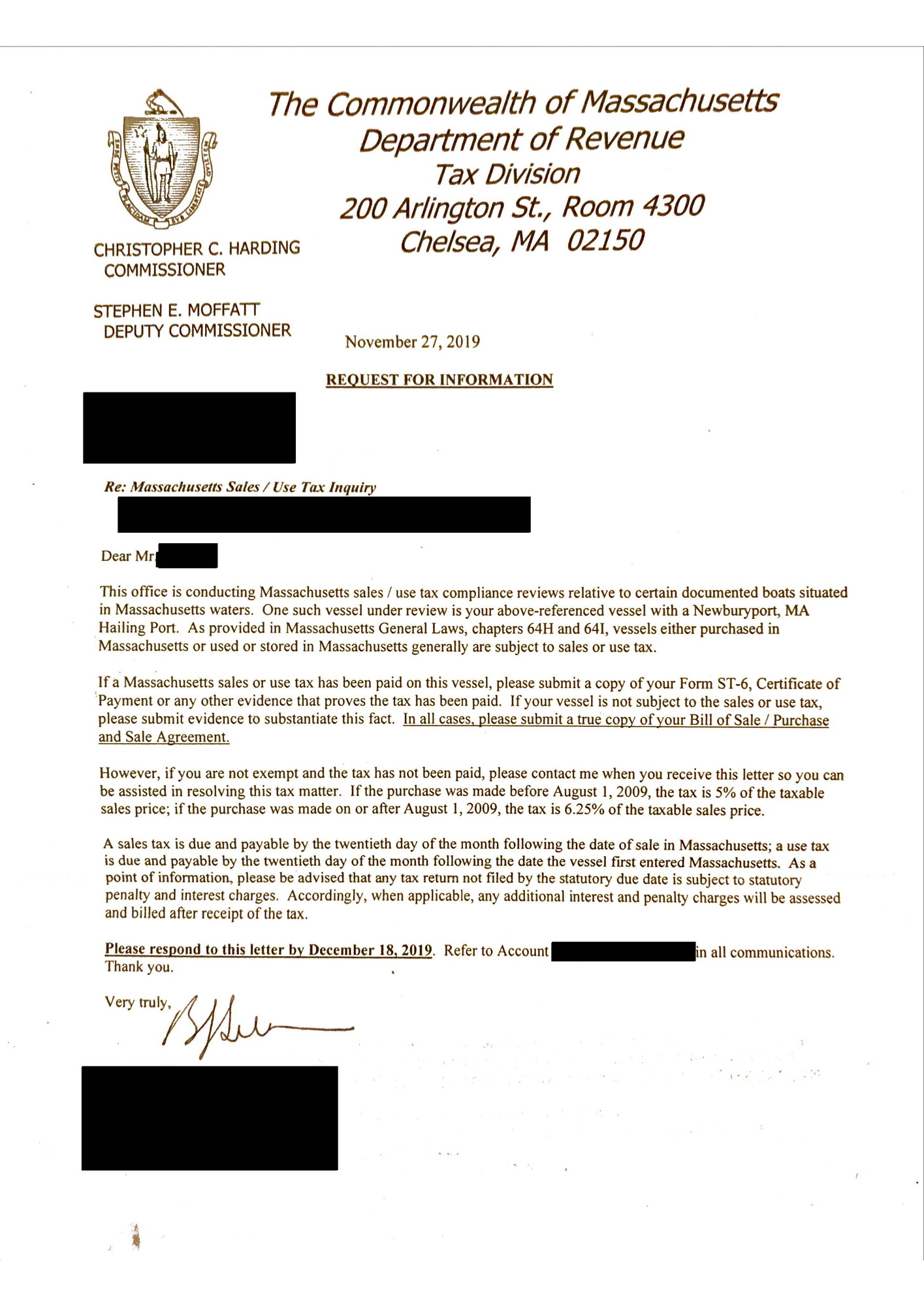

Massachusetts Sales Tax The Hull Truth Boating And Fishing Forum

Massachusetts Sales Tax Small Business Guide Truic

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov